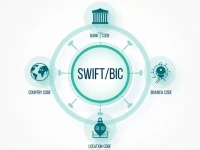

SWIFTBIC Codes Vital for International Money Transfers

This article begins with the structure of SWIFT/BIC codes and delves into the significance of national banks in international remittances. It emphasizes the necessity of entering the correct code for successful transactions and recommends Xe as a high-quality remittance service provider to enhance the overall remittance experience.